Home Equity & Home Improvement Loans

Using the Equity in your Home

Use the equity in your home to borrow from Milford Federal at preferred rates. Proceeds of these loans can be used for any purpose (a new roof, a second car, college education or a long overdue vacation). Interest is often tax deductible (applicants should check with their tax advisor).

Home Equity Loans

Loans offering attractive fixed rates for the life of the loan are available for amounts ranging from a minimum of $10,000 to an amount not to exceed $750,000 when combined with the first mortgage. Terms are available from 1 year to 20 years. Ideal for the home owner with immediate cash needs who wants the comfort and convenience of fixed monthly payments.

Apply Now!

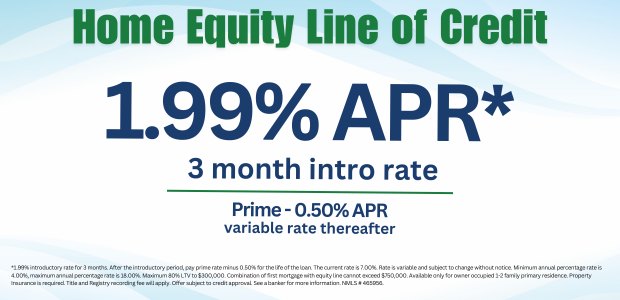

Home Equity Lines of Credit

HELOC Special 1.99% APR introductory rate for 3 months. After the introductory period, pay prime rate minus 0.50% for the life of the loan. The current rate is 7.00%. Rate is variable and based on the Wall Street Journal’s prime rate minus 0.50% for the life of the loan. Our minimum rate is 4.00% APR and maximum rate is 18.00% APR.*

No application, processing or membership fees, and interest is charged only on the amount you actually borrow with our revolving home equity line of credit. Lines are available for amounts ranging from a minimum of $10,000 to an amount not to exceed $750,000 when combined with the first mortgage. Just write a check to get the funds you want and pay it back in monthly installments (of course, extra principal payments can be made at any time).

Apply Now!

Home Improvement Loans

Milford Federal can help you add value to your home with a new kitchen, an addition or simply new paint and wallpaper with a quick and easy financing program tailored to your specific needs. Terms on secured home improvement loans to $150,000 are available up to 20 years. If you need additional information, please contact us, or stop in at any of our four banking offices.

*1.99% introductory annual percentage rate (APR) for 3 months. After the introductory period, pay prime rate minus 0.50% for the life of the loan. The current rate is 7.00%. Rate is variable and subject to change without notice. Maximum 80% LTV to $300,000. Combination of first mortgage with equity line cannot exceed $750,000. Available only for owner occupied 1-2 family primary residence. Property Insurance is required. Title and Registry recording fee will apply. Offer subject to credit approval. NMLS # 465956.